Licensing SinglePoint’s Umbrella rating component provides access to the rates of the carriers listed below. To add a specific carrier’s Umbrella rates to your available plans, go to SinglePoint, then Rating, and select the carrier(s).

Carriers supported for umbrella rating

Andover

Arbella

Barnstable

Bunker Hill

Chubb

Commerce

Concord Group

Firemans Fund

General Casualty

Hanover

Harleysville

Holyoke

National Grange

NGM Insurance

Norfolk & Dedham

Preferred

Providence

Quincy

RLI

Safety

Travelers

Union Mutual of Vermont

Utica

Vermont Mutual

To integrate credit report retrievals within SinglePoint:

- Contact your carrier marketing rep(s) and request this functionality;

- Each carrier handles this a little differently, but you must complete some paperwork; your carrier, LexisNexis, and Boston Software will set up the permissions on your behalf. This may take a couple of weeks.

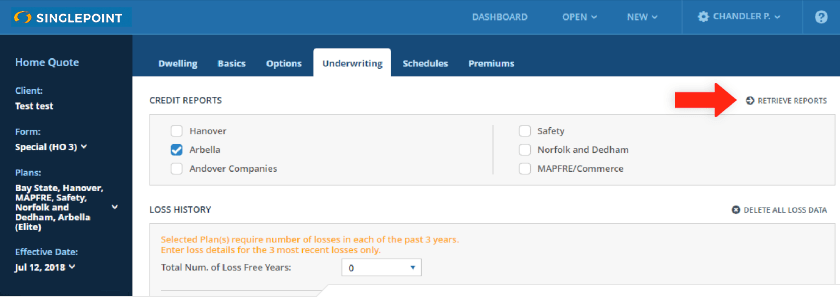

Retrieving credit scores in Home Rating:

While quoting a Home risk in SinglePoint, click the Underwriting tab to initiate the credit report retrieval process. A list of your credit lookup enabled carriers will appear. Select the desired carrier(s) by checking the appropriate boxes. Click Retrieve Reports to start the retrieval.

The FCRA disclosure will display. Click Yes to indicate that you understand and accept the terms.

When the credit report retrievals are complete, click the hyperlinks beside each carrier to view and/print the individual reports.

Participating carriers:

- Andover Companies

- Arbella

- MAPFRE

- Hanover

- Norfolk & Dedham

- Safety